Master Your Money,

Master Your Life

"A step-by-step journey to financial independence,

smarter decisions, and a brighter future."

Take control of your financial future with our comprehensive online

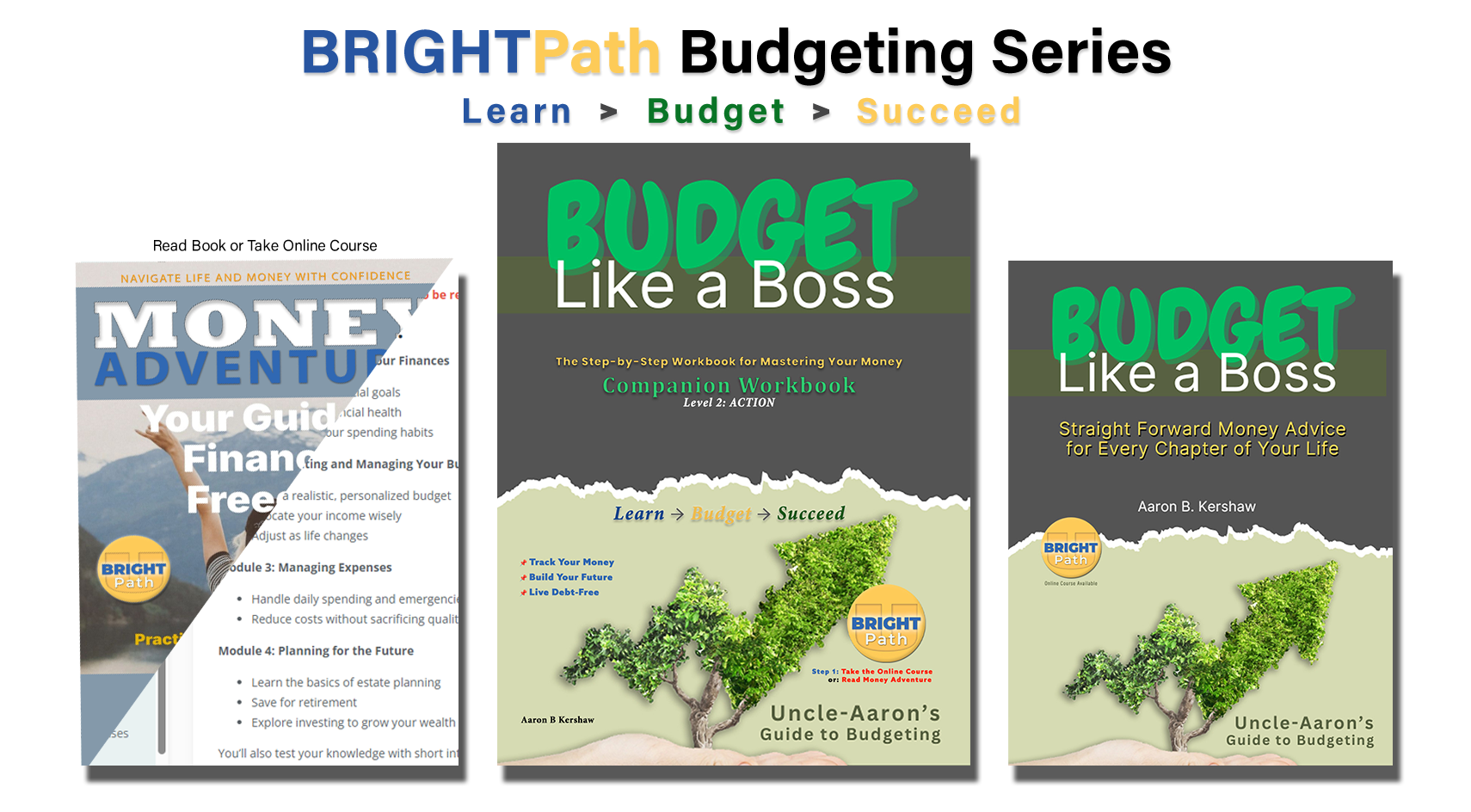

course based on the bestselling book Money Adventure: Your Guide

to Financial Freedom. Learn practical strategies, avoid common pitfalls,

and build a personalized plan to achieve financial freedom—at any stage of life.

Interactive Lessons:

Engaging, bite-sized modules tailored to real-life scenarios.

Actionable Strategies:

From budgeting to investing, learn skills you can implement immediately.

Expert Guidance:

Insights inspired by the book and adapted for an immersive learning experience.

What You'll Learn:

- How to create a realistic budget that works for your lifestyle.

- The secrets to saving for both fun and the future.

- How to turn your skills into side hustles or full-fledged businesses.

- The ins and outs of investing, retirement planning, and building wealth.

- How to avoid financial pitfalls like payday loans, lifestyle inflation, and predatory scams.

- Techniques for managing debt and building a strong credit score.

- Smart strategies for achieving financial freedom and defining your personal success.

Who This Course Is For:

- Young professionals eager to start their financial journey on the right foot.

- College students and recent graduates navigating money for the first time.

- Entrepreneurs looking to manage their finances while growing their businesses.

- Anyone ready to take control of their financial future and live life on their own terms.

Why Choose This Course?

- No Jargon, Just Results: Designed for everyone, no prior financial knowledge required.

- Flexible Learning: Complete at your own pace, on your own schedule.

- Proven Strategies: Tried-and-tested advice rooted in the bestselling book.

- Real-Life Scenarios: Practical examples to help you apply what you’ve learned.

Course Modules:

- Financial Foundations: Understand money, master the psychology of spending, and build a strong financial base.

- Building Wealth: Create income streams, start side hustles, and learn the basics of investing.

- Adulting Essentials: Navigate insurance, debt management, and financial decision-making with confidence.

- Achieving Financial Freedom: Set financial goals, prepare for retirement, and define what financial freedom means to you.

- Advanced Wealth Strategies: Avoid financial pitfalls, improve your credit score, and develop a wealth-building mindset.